a guide to help sell a

probate or inherited property

Our experience means we know just how emotional and draining this period can be for people. In many cases, you are not just selling bricks and mortar, but letting go of treasured memories and deep emotional bonds. We never forget that, and compassion and passion are at the core of our service to people in this situation. Our aim is to help and guide you during these times and to become your support partner for the property’s sale.

Selling probate or inherited property can be a very complicated matter depending on the size of the estate. And that’s why we’ve created this introduction to it. The information we share is based on experience and does not constitute legal advice. We can, if necessary, introduce you to experienced and trustworthy solicitors who know the local property market. After reading this, you may find it beneficial to have a no-obligation, confidential chat with us about your situation.

- a brief guide to probate

what is it?

It’s the formal permission needed to deal with someone’s estate, basically their property, money, and possessions when they die.

If you are named in the deceased person’s will as an executor, you can apply for probate.

But even if they didn’t leave a will, depending on your relationship to them, you can apply to become the administrator of the estate.

In most cases, you will need legal permission to sell their property, hence the need to apply for probate.

Prepare Properly

Before applying for probate, it’s advisable to do some preparations if a property is part of their estate.

- Estimate the value of the deceased’s assets.·

- From a property perspective, it’s wise to get two or three valuations from respected local estate agents.·

- Be clear of any valuation as this may have inheritance tax implications further down the line. We suggest contacting HMRC or a solicitor who can advise you professionally.

- Five things to consider

1. Letting Go

The sentimental value of a loved one’s items shouldn’t be underestimated. And that’s why the clearance of their belongings and furniture needs to be handled with care and consideration. Wherever possible (and after legal advice), it’s often best to gather the family together to see who wants what and what items can be removed by a clearance company or donated to charity shops.

2. Security and Maintenance

If you are applying for probate, the property could be vacant for months. This means the security of the home needs to be looked at. Maintenance can also be an issue. In the colder months, the heating and water system needs to be regularly checked. In warmer months, the outside of the property may need care, especially as many potential buyers will be put off online by photos of overgrown gardens or broken fences/gates.

3. Insurance Cover

This is often overlooked when a homeowner has died, and the property sits vacant. Ideally, contact your insurance company, explain the situation, and see what levels of cover are available. Most offer ‘vacant property insurance’, a necessary cost for any property left unoccupied for more than 30 days.

4. Keeping It in the Family

Once probate is granted, selling to a family member may look like a relatively easy option. However, it can work out to be more complicated than a sale to a stranger. This is due to the needto agree on a suitable price, work to a timeline, and the emotions which are sometimes involved.

5. Quick Sale Caution

There are many companies out there that promise to buy properties quickly for cash. And as attractive as a quick cash sale can sound during a testing period of your life, you and any other beneficiaries of the sale can end up with thousands of pounds out of pocket. This is because the property hasn’t been professionally marketed as it would be if you sold it through a reputable, local estate agency.

Your FAQ's answered

My parent has died, leaving behind a property, what should my first step be?

While we’ve seen some people handle a probate sale on their own, the vast majority contact a solicitor who is experienced in these matters to work on their behalf. That’s why we suggest contacting a local one who knows the area and the agencies that work within it.

How will I know I’m getting an accurate valuation for sales and tax purposes?

Any agent can pluck a juicy looking figure out of the air. But be warned, proceed with caution when you encounter this approach. You need to think like a detective here and ensure any valuation is backed up with comparable evidence which shows similar properties in the area achieving the price suggested. Successful sales leave clues behind, and the main indicator is that the property was valued correctly.

Does it cost more to sell a probate property?

The sale shouldn’t incur higher legal fees than an ordinary property sale. However, there are additional costs to consider, like insurance and maintenance.

Should I refurbish the property ready for sale?

Although a fresh coat of paint never goes amiss, you might not need to spend as much as you think you do. Each property is different, but our general advice here would be to make the property as clean and obstruction-free as possible. We can recommend trusted local companies who handle house clearance, cleaning, maintenance and repairs. Gardens are increasingly in demand since the pandemic, so if your property has one, ensure the front and back areas are neat, tidy, and easy on the eye.

What should I do about Inheritance Tax (IHT)?

This is a complex area, and different properties fall under separate tax brackets. We suggest not going down the DIY Google route and instead speak to your accountant, solicitor, or qualified IHT adviser. This way, you can avoid any

unexpected tax bills.

I don’t live locally, so how will viewings be handled?

We will accompany all viewings as standard. And as a local estate agent, we will also regularly visit the property to check everything is ok with it. We can

arrange for local tradespeople to carry out any maintenance and we work with

trusted house clearance companies.

Can I market the property while I’m awaiting probate to be granted.

Yes. But you cannot legally complete on the sale until probate is granted.

How would you market the property?

We apply a different strategy to each property – because no two properties or sellers’ situations are the same. Fundamentally, we look at three core areas when we’ve been instructed to work for a client.

1) Location – Where the property is and the amenities, services, and environment around it.

2) Presentation – What condition is the property currently in and how could it be improved if necessary.

3) Process – As mentioned above, any agent can promise a price. What is far more beneficial to you is knowing the process your agent will follow to ensure the best price is achieved.

What is the difference between using an estate agent and going to auction or a quick buying service?

While an auction and cash buying companies may provide a faster route to a sale, it often means you could be missing out on thousands. As a trusted estate agent working as your support partner through this process, we will be on hand to guide you every step of the way. You’ll have access to our extensive network of local contacts, and our area knowledge and database of people looking to move means we’re very confident in achieving you the best possible price with the minimum of stress and disruption.

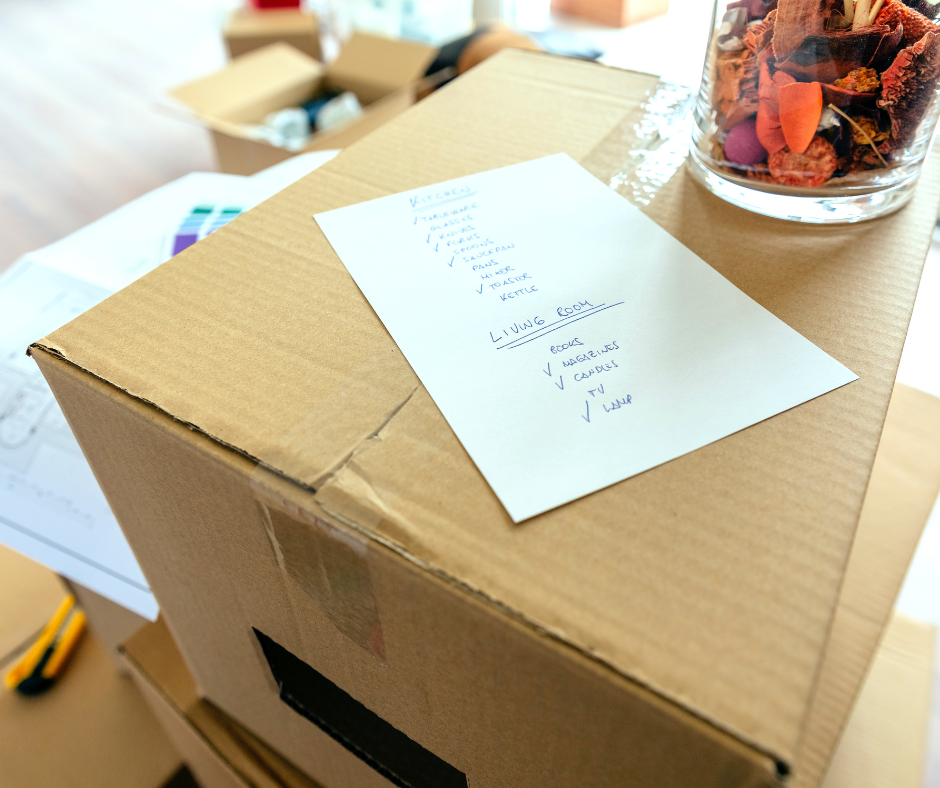

Your Moving Checklist

Below is a useful 11-point checklist to help you prepare for a sale.

-

Probate Solicitor

If probate is involved, arrange a call with a solicitor who is experienced in this area.

-

Accountant

Speak to your accountant or tax adviser about any Inheritance Tax issues.

-

Valuations

Get three estate agents to value the property.

-

Choose The Right Agent

Choose the agency who provides the evidence to back up their valuations.

-

Auctioneers

If the property has valuable items, it may be worth getting an auctioneer to value them. Check with your solicitor to see if any legal implications apply to the probate before doing this.

-

Clearance

Arrange for a home clearance company to visit the property, if required.

-

Cleaning

Arrange for a cleaning company to attend the property, if necessary.

-

Utilities

Ensure that the drainage and heating systems have been checked.

-

Insurance

Arrange vacant property insurance. Sometimes insurers will insist that step 8 has been taken before issuing cover.

-

Important Documents

Create a safe place for any paperwork you may need to refer to.

-

Instruct an agent

Instruct your agent to start marketing the property following the process they have in place.