Guide to selling your home when

Upsizing

We call it ‘right-sizing’ because it’s about finding the right size home, whichever life stage you’re in.

Some people are excited about the idea of moving to a new, more spacious home where they might feel less cramped. Others are anxious – it’s a significant step, and many of the people we help haven’t sold a property for a little while. It could even be the first time.

We understand that in many cases, you are not just selling bricks and mortar but changing your lifestyle. You know the end goal will be positive but when you’re already very busy, the upheaval is yet another thing for you to deal with.

There are specific steps you can take to help you smoothly embark on the next chapter of your life. And we share them in this guide.

- Why people upsize

Romantic Relationships

You’ve met each other’s friends and been to some family events. It’s time to pool your resources, stop living out of a suitcase, and get a bigger place together.

The Pitter Patter of Tiny Feet

You’d like to start a family. You might want to grow your family. You know you need more space. A baby focuses the pain points of your current property and you know you need to upsize. How do such small humans need so much stuff?

New Career Move

You’ve finished your training. You’ve got that promotion. You’ve switched careers. Moving for work is a common reason that enables an upsize as you’re likely to be in a better financial position to get what you really want after moving on from your starter home.

Family Ties

Often, people move home to be nearer to family. This might be to support your parents as they’re getting older or to be more involved with nieces and nephews. You need more space to have them all round.

Living Luxuriously

You’re a savvy saver and have been working hard. It’s time to move up the ladder and put your money where it’s safest – by investing in a larger property.

Older Kids or Relatives

Sometimes upsizing stems from a change of needs. Maybe an older family member needs to move in with you or your children are getting older and need more space and that must-have for all teenagers – their own room.

- our four tips for your next step

1. Get the right advice

We understand how hard it is to find the time but getting the right advice at the start of the process will end up saving you time and, more often than not, money over the course of the whole transaction. Google can tell you a lot of things but there’s nothing quite like having an experienced estate agent at the end of the phone to give you accurate and bespoke support.

2. If it looks too good to be true...

When you’re busy, quick sale companies can seem appealing. They have their place but usually as a last resort.

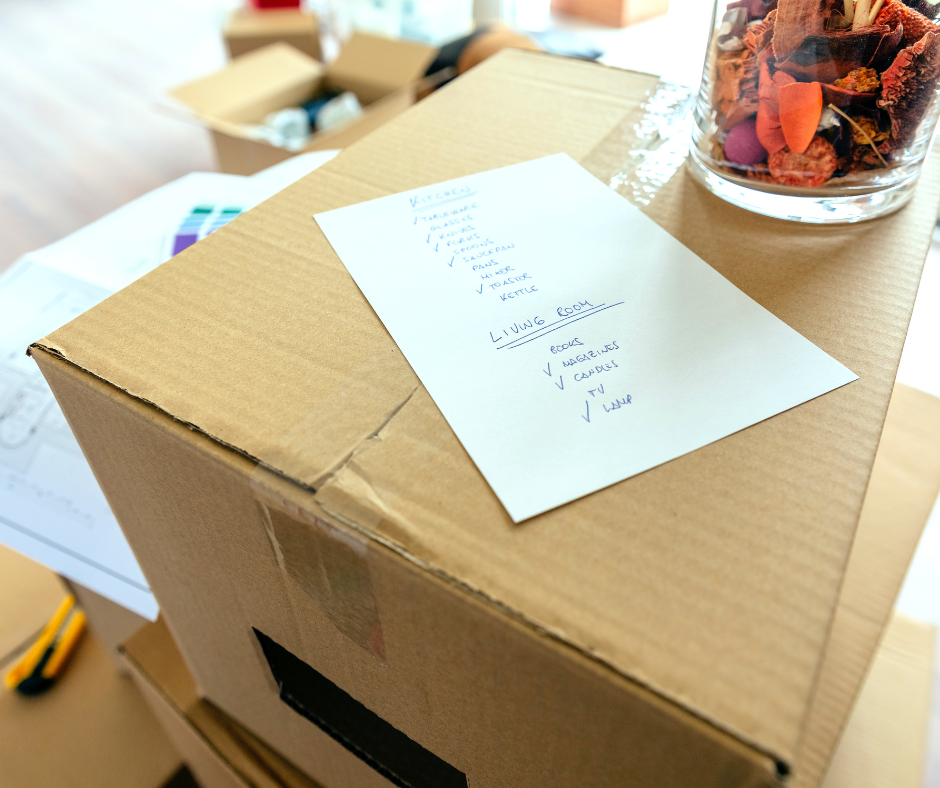

3. Planning and packing

There’s a lot to get sorted when you’re moving. Make a list of jobs to do around the house and work your way through them. Get your financial and legal paperwork in order as early as you can. Start packing. Pack everything away that isn’t useful in your daily life. Personal items like photos, ornaments, seasonal clothes or toys can all be the first things to be boxed up. It makes tidying for viewings easier, too.

4. Assess the market

Some estate agents use the unscrupulous practice of valuing your home for an unrealistic price. However, your property then ends up stale and stagnant on the market. You just don’t have time for that. Get three agents round to carry out a valuation or market appraisal. Assess them, not on the figure that makes you see pound signs in front of your eyes, but on the clearest comparables and most comprehensive plan of how they’ll help you achieve your goals.

Your FAQ's answered

I/we need a particular figure for this property to make the move possible. What can you do to make that happen?

No good estate agent can guarantee you a specific amount, but they can support you in achieving the best possible price for your property in the market.

The caveat for this is your goal figure must be realistic and achievable.

Four factors influence the outcome:

1) The location of the property itself, the nearby amenities, general environment, and services in the area.

2) The presentation of the property, current condition, and possible improvements required.

3) The estate agent you instruct to manage the sale. Good, experienced agents will be able to achieve several thousands more for your property through their practised skill.

4) The strategy for selling. Make sure your estate agent has a good plan in place, so you know what they’re doing and if you need to do anything, too. We can advise you on this.

How long will it all take?

How long is a piece of string?

Seriously though, a lot of it boils down to the four factors. The earliest offers are generally the best ones – when your property is new and fresh on the market. This can happen quite quickly for some properties.

The next stage involves the mortgage providers, building surveyors, solicitors and other agencies involved if you are part of a chain. This can be a difficult and drawn-out process, but not always.

We make sure to communicate with everyone during this stage so you’re never out of the loop.

Which solicitor should I/we use?

A bit like when you’re choosing estate agents, it can seem really tempting to choose a solicitor based on their fees.

Unfortunately, it’s often a case of getting what you pay for. That’s not to say you need to hire the most expensive firm in the market.

We know the good guys and the less great guys, so just ask. We are always happy to share our experiences to make sure you avoid any pitfalls.

What other costs are involved?

As part of point three from our Top Tips (see previous page), it’s worth thinking about every element when you’re planning.

You might need to spend a little on getting the house itself ready.

There are Stamp Duty costs when you’re buying in the UK.

We can chat through all of that with you as it depends on what you’re looking to buy. The solicitors will charge a fee and there’s also fees within that (depending on their payment structure).

You might need to hire a van or a moving company to help on moving day.

We’re used to it all and can explain it for you so you’ve got it straight in your mind and don’t end up with any panic situations that you just don’t have time for.

How do I know if I can really afford to do this?

With a bigger property often comes an increased monthly mortgage cost. Your council tax and other bills are likely to increase, too.

On top of these, a bigger place means more responsibility. This might mean a bigger garden to manage or more gutters to maintain. You might also need to spend out on new furniture to make the new space work for you.

Don’t just doodle some sums on the back of a napkin! All great estate agents know equally great, independent financial advisers.

Get a professional in to chat it all through. They can help find you the best deals in the market on things like mortgages and insurances.

The initial outlay for their time will often end up making you money as they can advise on ways to maximise your money with investments and pensions.

Your Moving Checklist

Below is a useful 11-point checklist to help you prepare for a sale.

-

Packing

Start packing away items that are not useful every day. You will probably even find bits you can sell or give to charity shops that will help you declutter (and lower your moving costs).

-

Food

Work your way through the food in your cupboards and freezer.

-

Valuations

Invite three estate agents round to value the property. Do not be won over by cheap fees or high valuations. Ensure you’re looking out for a figure based on well-researched evidence and backed up with a comprehensive plan.

-

Solicitor

Hire a solicitor who is specialised in conveyancing for your type of property or area. Professional recommendations are often better than your friends who have had an okay experience. They’ve only got one point of reference compared to a good estate agent who deals with hundreds of transactions a year. This bird’s eye view of the marketplace gives you assurance you’ll be dealing with the best firm for your needs.

-

Removals

Once you’ve accepted an offer and agreed a completion date, ask for three recommendations for moving companies. Check the reviews and get them booked for your date. Good people get booked up fast.

-

Post & Utilities

Set up a post redirect for your property and make sure you tell the utility companies, banks, and insurance providers the change of address. You could even get some pretty notelets and send traditional ‘change of address’ cards to family and friends.

-

Insurance

Get prepared with some insurance quotes for your new property (if relevant). Ask them to start the policy from your exchange of contracts date so you’re covered immediately.

-

Essentials

Sort yourself a final night/first morning box with a kettle, cups, coffee, tea, and loo roll. A wash bag and change of clothes are always useful, too. Make sure you’ve got any necessary paperwork, medicines, wallet, keys, and ID in a separate bag.